With millions of consumers worldwide already using crypto daily, businesses are starting to see clear benefits in integrating it as a payment method. From attracting new customer segments to reducing payment processing fees, crypto offers opportunities that traditional banking cannot match.

In this article, BitHide team break down everything your company needs to start accepting crypto payments safely and efficiently. You’ll learn what to look for when choosing a crypto payment solution to ensure it is secure, reliable, and integrates seamlessly with your current workflows.

Why Accept Crypto Payments?

Before diving into integration details, it’s worth understanding why crypto payments matter for businesses today:

- No chargebacks. Blockchain transactions are final and irreversible, eliminating fraud risks tied to forced refunds.

- Instant settlement. Funds are received within seconds or minutes, unlike traditional banking delays of days.

- Lower fees. Processing costs are often significantly cheaper than credit cards or bank wires.

- Global accessibility. Customers from any country can pay without worrying about local banking restrictions.

- Privacy for clients. Many users prefer crypto payments for confidentiality, especially in high-risk or high-value transactions.

Businesses that accept crypto become more competitive and flexible compared to those that don’t. They can reach new customer segments, offer diverse payment options, and adapt faster to the changing global economy.

How to Choose a Crypto Payment Gateway for Your Business

To start accepting crypto, you’ll need to integrate a crypto payment gateway (or crypto wallet) into your website, sales platform, or CRM. Here are essential factors to evaluate when choosing the right solution:

API Integration

Your crypto payment gateway must support API integration, allowing seamless connection with your existing website, accounting software, or ERP systems. A well-designed payments API ensures that transactions can be processed, tracked, and confirmed in real time without manual intervention. Without API support, automating payments and confirmations becomes impossible, forcing manual work and increasing the risk of delays and errors.

Non-Custodial and Self-Hosted Architecture

Always choose a non-custodial solution that gives your business full control over private keys and funds. Custodial gateways hold your assets on their servers, exposing you to risks of freezes, seizures, or third-party breaches.

A self-hosted gateway, installed on your own infrastructure, ensures:

- Full ownership of assets

- No external interference

- Compliance flexibility based on your jurisdiction

This architecture also improves security, as only your company manages sensitive data and keys.

Two-Factor Authentication (2FA)

2FA is critical for preventing unauthorised access. Even if passwords are compromised through phishing or data leaks, transactions and logins remain protected by a second verification step. Look for gateways that support biometric fingerprint 2FA or hardware token integration for maximum security.

Multi-Wallet Support

Most businesses operate with multiple wallets:

- To separate revenue streams across products or departments

- For easier reporting and tax compliance

- To allocate funds for specific projects or payouts

Choose a payment gateway that allows creating an unlimited number of wallets and addresses under one management interface.

Built-In Crypto Exchange

A built-in exchange function allows you to:

- Instantly convert between different crypto assets and stablecoins

- Reduce exposure to market volatility

- Save time by avoiding transfers to external exchanges

For businesses receiving payments in multiple tokens, this feature improves efficiency and cost management.

Integrated AML Checks

Compliance is a growing challenge in crypto. Even if your company operates legally, receiving funds linked to fraud, mixers, or sanctioned wallets can result in:

- Frozen assets

- Blocked exchange accounts

- Reputation damage

Choose gateways with built-in AML screening that assess the risk level of incoming transactions and flag suspicious addresses before funds are accepted into your operational balance.

Role-Based Access for Team Members

Operational security is not just about external threats. Internal mistakes or malicious actions are major risks. Recent hacks, like the Coinbase data breach in 2025, highlight how insider access remains a weak point.

Your platform should allow:

- Custom roles and permissions per employee

- Segmented access (e.g. accounting sees reports, treasury approves payouts)

- Full audit trails for accountability

Encrypted Backups

Imagine your hardware fails or is attacked by ransomware. Without backups, you risk permanent data and asset loss. Your crypto payment solution must support encrypted backups that can be quickly restored to ensure business continuity.

Real-Time Reporting and Financial Tools

For effective crypto treasury management, your gateway should include:

- Balance and transaction reports, exportable for accounting and compliance.

- Bulk payouts to automate payments to multiple suppliers, partners, or employees.

- Auto-withdrawals, transferring funds automatically when balances exceed set thresholds.

These tools streamline daily workflows and minimise human errors.

IP Address Protection

Blockchain transactions aren’t private by default. When your wallet connects to a node, it shares its real IP address. If hackers or malicious actors control that node, they can trace:

- The physical server location

- Your company’s operational infrastructure

- Potentially the identity of wallet owners

Advanced gateways mask IP addresses effectively by combining VPN and Tor routing to prevent such deanonymisation attacks.

Additional Considerations for Business Success

- Customer experience: Payments should be processed quickly with user-friendly invoices or checkout interfaces.

- Regulatory compatibility: Ensure your gateway aligns with local tax and compliance regulations.

- Vendor reputation: Choose solutions with proven security audits and strong user reviews.

- Scalability: As your crypto volumes grow, your gateway must handle increased transaction load without downtime.

Conclusion

Cryptocurrency payments are no longer just a futuristic idea – they’re a practical, competitive advantage for businesses today. By integrating a crypto payment gateway with features like non-custodial architecture, strong IP protection, built-in AML tools, multi-wallet management, and real-time reporting, your company gains full control, security, and operational efficiency.

When evaluating options, ensure the solution aligns with your security policies, compliance standards, and operational needs. With the right setup, accepting crypto payments can become a smooth, profitable addition to your business model.

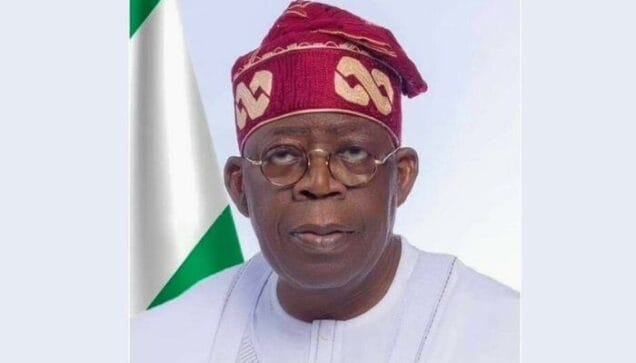

BY DAMILOLA ADELEKE | JULY 19, 2025

Adeleke Damilola (ACTION) is a versatile content writer with expertise in news writing and a seasoned media professional and broadcast specialist. Currently serving as News Editor for DNews Info, Damilola is also the CEO of the ACTION brand, committed to shaping lives and establishing a legacy of excellence for present and future generations.

Discover more from DnewsInfo

Subscribe to get the latest posts sent to your email.